Lots of people use banks every day, and they do not understand the big picture of how banks work. Many people see banks as a place to save money, get loans or what is savings accounts vs current accounts. However, they fail to realize how banks are also providing more services. Bank as a service provider plays an essential role in every person’s life. If you want to know more about these services, then read our blog.

Precap: Bank As A Service Provider

What is a bank?

What is a banking service?

Types of banking services

What Is A Bank?

It is a financial institution that accepts money from the public for deposits and making loans. There are many types of Bank including:

- Retail Banks

- Commercial banks

- And investment banks.

- In most countries, banks are regulated by the central Bank.

What Is Banking Service?

A deposit, loan and other banking facility provided by a bank to a customer/consumer is called banking services.

Banks provide bank services because they want to attract customers by giving loans, credit and debit cards, digital financial services, and personal services. However, some essential services are offered by most commercial banks.

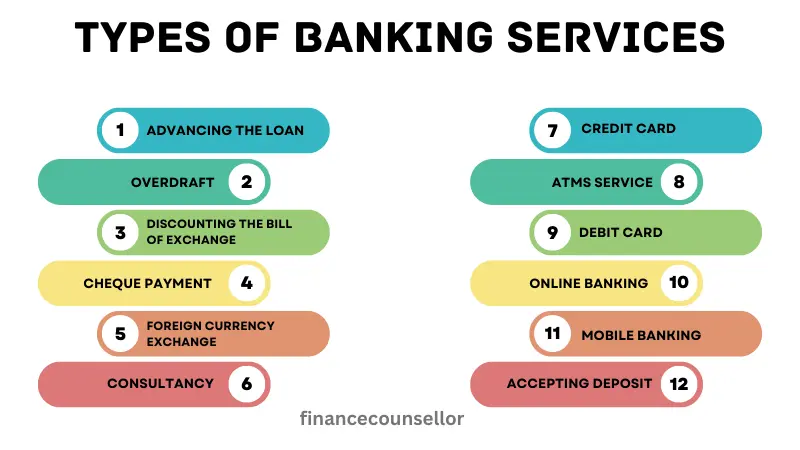

Types of banking services

Bank as a service provider, provides many different types of service. Below are some points that show some service.

Advancing the loan:

Banks are profit-oriented businesses. So they have to advance a loan to the public and generate Interest as profit from them. After keeping minimum cash reserves, banks provide short, medium, and long-term loans to needy customers.

It is similar to other types of term loans but with an advancing period in which the business only makes interest payments; that advancing period gives the business some extra leeway in making use of the capital provided before full payments are sent.

Overdraft:

It is a negative balance in the customer’s account, but it is different from cash credit. An overdraft occurs when customers spend more money than they have available in their current account, and the bank pays the customer’s transactions anyway.

Interest is charged from the customers on the overdraft amount they use.

Discounting the bill of exchange:

It is a financing transaction where a company sends an unexpired commercial Bill of exchange to the bank in Return for an advance of the amount of the bill, less Interest and fees.

A bill of exchange holder can get it discounted by the bank. The debtor accepts the bill drawn upon him by the holder of the bill and agrees to pay the money mentioned on maturity.

Cheque payment:

It is a written order to pay, which is signed by the customer and given to another party as payment. When a customer pays using a cheque, customers are instructing their financial institution to give money from their account to the person/organization that is depositing the cheque.

Banks provide cheque books to bank account holders. Customers can draw cheques from the bank to pay money. Banks pay the cheques of customers after formal verification and official procedures.

Foreign currency exchange:

Banks deal with different foreign currencies; as customers’ requirements, banks exchange foreign currencies with local currencies, which is important to settle down the dues in international trade.

Consultancy:

Bank consultants are financial professionals who work with banks and other financial institutions to help them develop new financial products, improve existing offerings, and manage risk.

Credit card:

A credit card is a thin rectangular piece of plastic or metal issued by a bank or financial institutions company that allows credit cardholders to borrow funds.

It is a financial tool where a bank gives you a loan (credit limit) that you can use for everyday expenses or large purchases. The credit cardholder promises to pay back the use amount to the card provider over time and with Interest.

ATMs service:

This stands for automated teller machine, which is a specialized computer that makes it convenient to manage a bank account holder’s money. It allows a person to withdraw or deposit money, to check account balances, and print a statement of account activities or transactions.

ATMs replace human bank tellers in performing banking functions like deposits, withdrawals, and account inquiries. Here are some advantages of ATMs.

- 24-hour availability.

- beneficial for travelers.

- low labor cost.

- Convenience of location.

- Cheaper to Maintain.

- Less human errors.

- Ensures privacy to the customers.

- Withdrawal of money is faster than bank withdrawal.

Debit card:

It is a payment card that deducts money directly from the cardholder’s account when it is used. It is also called check cards and bank cards, they can be used to buy goods or services. Most debit cards require a personal identification number (PIN) to be used and verify the transaction.

Online banking:

It means accessing your bank account and carrying out financial transactions through the internet on your smartphone, tablet or computer/laptop. Online banking is quick, usually free and allows you to do tasks like paying bills, transferring money, balance inquiry and recharging without having to visit or call your bank.

It is also known as “Internet banking” or “Web banking. Account information can be accessed anywhere, anytime, day or night, and can be done.

Mobile Banking:

It is a service provided by a bank or other financial institution that allows its customers to do financial transactions remotely using a mobile device like a smartphone or tablet.

Mobile banking is also known as M-banking. It is a term used for performing balance checks, account transactions, payments, recharge, credit applications, and other banking transactions through a mobile device.

These services are provided by a bank as a service provider.

Accepting deposit:

It is the primary function of a bank (Accepting deposits from account holders). Banks receive the deposit from those who want to save money but cannot utilize it in profitable sectors. People prefer to deposit their savings in a bank because they earn Interest.

Conclusion: Bank As A Service Provider

Bank as a service provider plays an essential role in our life. Banks do many things, like accept deposits from account holders and pool them, and lend them to those who need funds. It works as an intermediary between depositors and borrowers. The money banks pay for deposits and the income they receive on their loans is called Interest (both amounts).

FAQs: Bank As A Service Provider

Que-1. How is a bank a service company?

Ans- A bank company is a service provider who provides one or more services to customers. Below are some services that are provided by a bank.

Que-2. What are the 5 most important banking services?

Ans- Top 5 most important banking services are:

-Checking and savings accounts

-Loan and mortgage services

-Wealth management

-Providing Credit and Debit Cards

-Overdraft services.

Que-3. How do banks make a profit?

Ans- Banks make money from the difference between the interest rate they pay for deposits and the interest rate they receive on the loans they make. Banks also earn interest on the securities they hold.